Agency Conflicts Between Managers and Shareholders

52 Dimensions of Ethics. 58 Emerging Trends in Ethics CSR and.

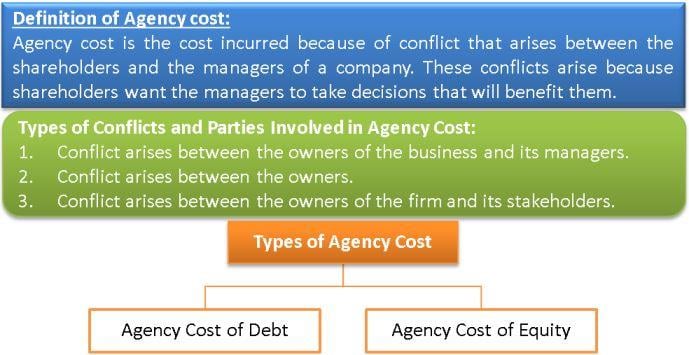

Agency Cost Its Types Viz Equity And Debt How To Reduce It

The essential tech news of the moment.

. Companies should generate investment returns for the risk capital put up by the shareholders. All shareholders should be treated equitably fairly including those who constitute a minority individuals and foreign shareholders. Shareholders and facilitate their rights in the company.

Management ownership helps reduce agency problems between shareholders and managers and the fact that managers have greater voting power guarantees their job stability so also. Agency Cost Of Debt. This type of director plays two important.

Get breaking Finance news and the latest business articles from AOL. The Australian Prudential Regulation Authority APRA is an independent statutory authority that supervises institutions across banking insurance and superannuation and promotes financial system stability in Australia. Corporate managers are the agents of shareholders a relationship fraught with conflicting interests.

America and the rest of the world are facing the confluence of three important and conflicting forces. A board of directors commonly referred simply as the board is an executive committee that jointly supervises the activities of an organisation which can be either a for-profit or a nonprofit organisation such as a business nonprofit organization or a government agency. And 3 the war in Ukraine and the accompanying humanitarian crisis with its impact on.

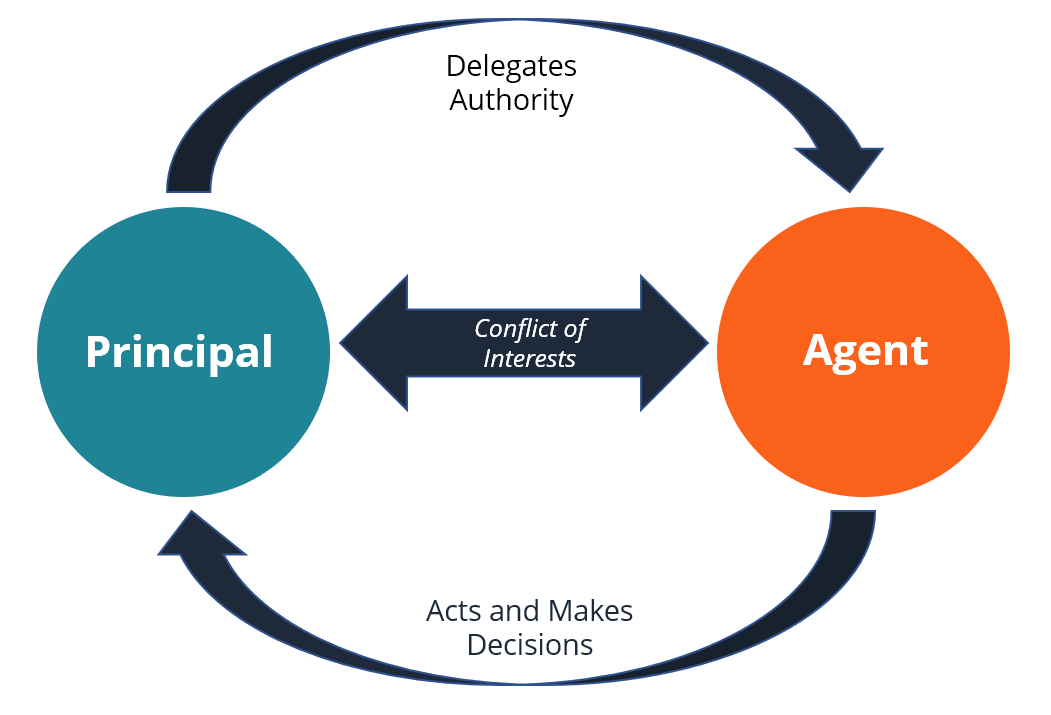

An agency problem is a conflict of interest between an agent and a principal where an agent is a person or group of people who performs a task on behalf of someone else the principal. The payout of cash to shareholders creates major conflicts that have received little attention Payouts to shareholders reduce the resources under. 2 high inflation which means rising interest rates and importantly the reversal of quantitative easing QE.

The powers duties and responsibilities of a board of directors are determined by government regulations. In corporate finance the agency problem. Agency theory the anal-ysis of such conflicts is now a major part of the economics literature.

A conflict of interest occurs when one party doesnt fulfill contractual obligations in favor of their own personal or professional interests. 1 Extension Amendment Proposal To amend Ariess Amended and Restated Articles of Association the Articles of Association to give the Company the right to extend the date by which it has to consummate a business combination the Combination Period up to twelve 12 times for an additional one 1 month each time from August 21. 56 Corporate Social Responsibility CSR.

Tribune Content Agency builds audience Our content engages millions of readers in 75 countries every day. The relationships between investment managers and corporate management is an especially common example of the principalagent relationship. From stock market news to jobs and real estate it can all be found here.

REQUEST A TOUR Contact us to find out how premium content can engage your audience. This problem may occur for example in the governance of the executive power ministries agencies intermunicipal cooperation public-private partnerships and firms with multiple shareholders. Since the shareholders approved managers to administer the firms assets a possible difference of interest occurred between the two groups.

Agency theory argued that in imperfect capital and labor markets managers were trying to find make best use of their own values without regard for corporate shareholders. Economy which we hope has COVID-19 in its rearview mirror. The agency problem is a conflict of interest inherent in any relationship where one party is expected to act in anothers best interests.

53 Ethical Principles and Responsible Decision-Making. 55 Ethics Corporate Culture and Compliance. Ethics at the Organizational Level.

Welcome to the team. Thank you Paulita and Rajib for your gracious invitation and kind welcome to this years program on current issues and trends in Investment Management. Equitable treatment of shareholders.

As I suspect many of you know and as the spring regulatory agenda demonstrates there is a significant list of current issues and trends in Investment Management under consideration at. Technologys news site of record. Evaluate whether independent agendas fit in corporate routines and reduce potential agency conflicts Yoo and Sung 2015.

1 a strong US. 57 Ethics around the Globe. Gil Thorp comic strip welcomes new author Henry Barajas.

51 Ethics and Business Ethics Defined. A problem arising from the conflict of interested created by the separation of management from ownership the stockholders in a publicly owned company.

Resolve The Conflict Between Managers And Shareholders

Agency Problem In Finance Overview Duties Examples What Is The Agency Problem Video Lesson Transcript Study Com

Principal Agent Problem Overview Examples And Solutions

0 Response to "Agency Conflicts Between Managers and Shareholders"

Post a Comment